Time.

Your most precious asset

Written by Nila Mistry

29/04/2023

Precious time

In many ways, time is our most valuable asset.

Treat time as your life’s currency. Once spent, you can never get it back. Spend your time wisely, with the people you love, in ways you’ll remember forever.

We can always make more money, but we can never make more time. When we spend our time as we want, we can pursue our passions, be with the people we love, and enjoy simple pleasures. For me, this is true wealth.

Everything I do is in the pursuit of freedom. To be free to choose, free to do the things that give me joy, and free to spend precious time with my young children.

We live in a world where wealth and success are almost synonymous, and success implies happiness. Rather than being measured in material possessions, wealth should be seen as a state of abundance in all areas of life, including relationships, personal growth, and inner peace. It’s time to break free from the false mindset that wealth means money.

I take full responsibility for my current and future happiness, and I want you to do the same!

Many of us grow up with certain money beliefs that have been passed down through our families and cultural backgrounds. While some of these views and values may serve us well, others may not. It’s important to ask ourselves whether we are simply following the patterns of previous generations without question or if are we open-minded enough to evaluate and make adjustments.

Don’t allow the pursuit of more to distract you from the pleasure of enough.

Read on as I share three simple steps . . .

vision

Creating a vision for your life is a powerful tool that can help you clarify your goals and focus your energy on what truly matters to you.

How we spend our time has a direct effect on our happiness. Do you have a clear understanding of where you are now and what your life looks like? Where do you want to be in 5 years, 10 years or longer? What does your future life hold?

The first step in creating a vision is to assess where you are in your life. Take a deep dive into the activities that you spend your time doing. Begin to identify the jobs, tasks, hobbies and treats that are essential to your well-being and success.

Review and evaluate your current situation, including your job, relationships, health, and overall sense of fulfilment. It’s essential to be honest with yourself and acknowledge both the positive and negative aspects of your life.

Now, visualise your ideal life in as much detail as possible. Don’t be afraid to dream BIG. To achieve freedom now and in the future, we need a clear view of our place and our destination. We need the big picture.

prioritise

Think about what’s most important to you – your personal goals, aspirations, and passions. What do you need to achieve freedom, financial security, and independence?

It’s essential to give attention and space to what makes you happy. Whatever your goals may be, prioritise them.

Setting out your priorities is a crucial step in any life plan. Create a mental picture of your future self. Be realistic but not limiting. There will be things you know you don’t want in your life and plenty of must-haves.

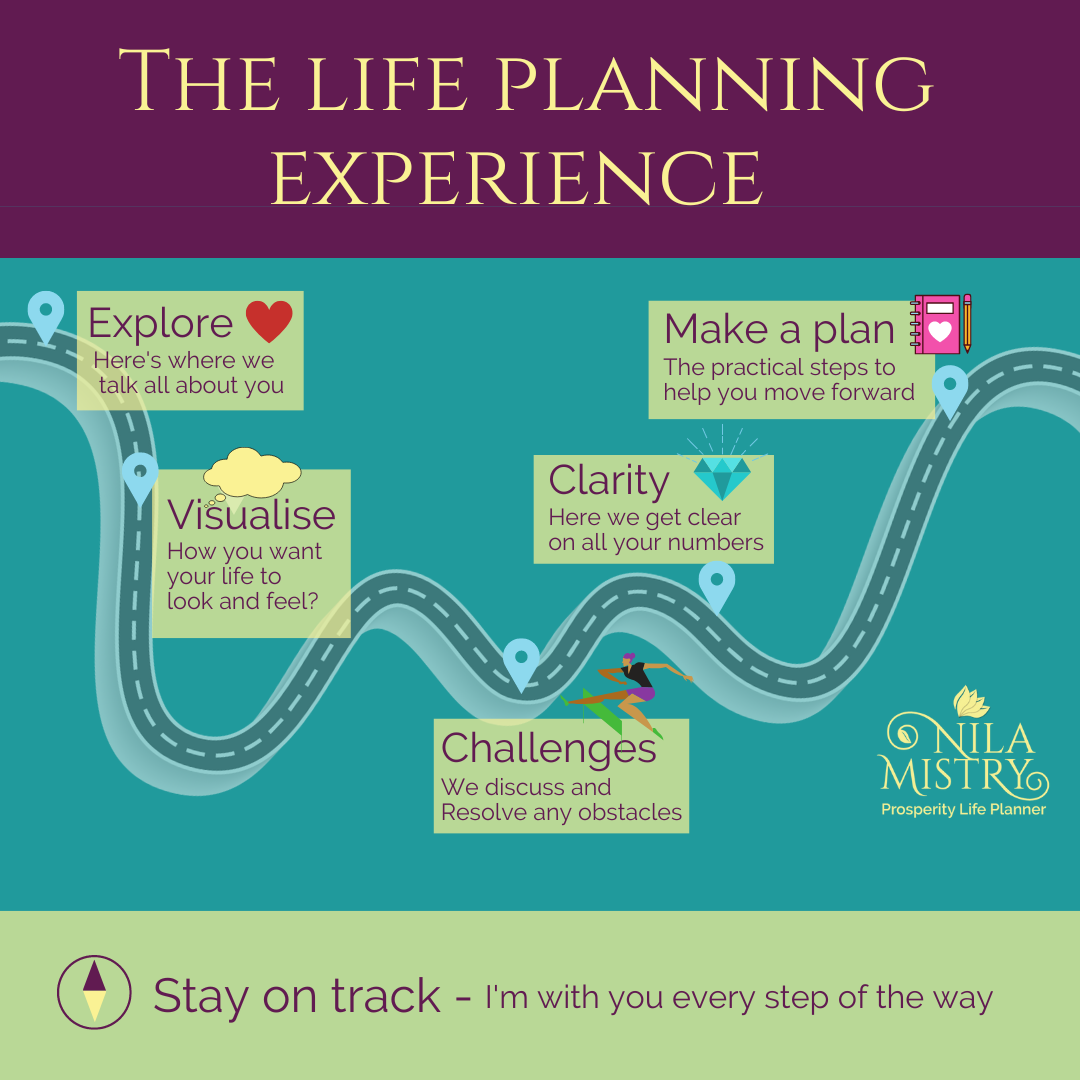

Create a plan

We can only be free to choose how we live if we have a plan.

As a financial life planner, I am my clients’ “thought partner”. Together, we challenge their thinking, root out misconceptions and build a targeted plan. The plan comes before the portfolio.

At its core, every plan is simply a series of steps to make things happen. Having a plan in place is crucial to bridge the gap between where you are now and where you want to be. It doesn’t have to be a purely financial plan.

You’ll have heard me talk about ‘freedom within a framework’. It’s a simple concept of balancing the freedom to live as you wish but to do this within boundaries. YOU create your own rules that provide you with structure and guidance. Within this framework, you have the freedom to make choices and exercise your discretion. Your decisions must align with your vision and your priorities.

The big picture

My role is to break down your plan into manageable steps you can take one at a time. By focusing on the next step rather than the end goal, you can avoid feeling overwhelmed. I can help keep you motivated as you make progress towards your financial and personal objectives. You must take responsibility for your financial future.

Ultimately, it’s up to each of us to decide what true wealth means to us. But by shifting our mindset away from money and towards time, we can start to live a truly fulfilling life.

Key takeaways

- Treat time as your life’s currency. Once spent, you can never get it back. Spend your time wisely, with the people you love, in ways you’ll remember forever.

- Don’t allow the pursuit of more to distract you from the pleasure of enough.

- Envision your future, prioritise what’s essential to YOU, and make your plan. Seek help from a financial life planner if you need clarity.

- Take responsibility for your financial future and your happiness. Now is always a better time for action than later or never!

Spend a little time today envisioning your future. If it feels uncomfortable,

get in touch. I’d love to help you prioritise and plan for the brighter future you deserve.